santa clara county property tax calculator

Finally the tax collector prepares property tax bills based on the county controllers calculations distributes the bills and then collects the taxes. Ad Calculate Your 2022 Tax Return 100.

Property Tax Calculator Estimator For Real Estate And Homes

Find All The Record Information You Need.

. For comparison the median home value in Santa Clara County is. Santa Clara County collects on average 067 of a propertys. Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local.

Property Tax Rate Property tax is generally calculated as the value of the ADU times the jurisdictions tax rate. A newly determined market value is then. Residents of the county can.

Easily E-File to Claim Your Max Refund Guaranteed. Learn all about Santa Clara real estate tax. You will need your Assessment Number Assessors Account.

Easily E-File to Claim Your Max Refund Guaranteed. Know what your tax refund will be with FreeTaxUSAs free tax return calculator. Santa Clara County Property Tax Calculator.

You will need your Assessors Parcel Number APN or property address. Welcome to the TransferExcise Tax Calculator. Ad Calculate Your 2022 Tax Return 100.

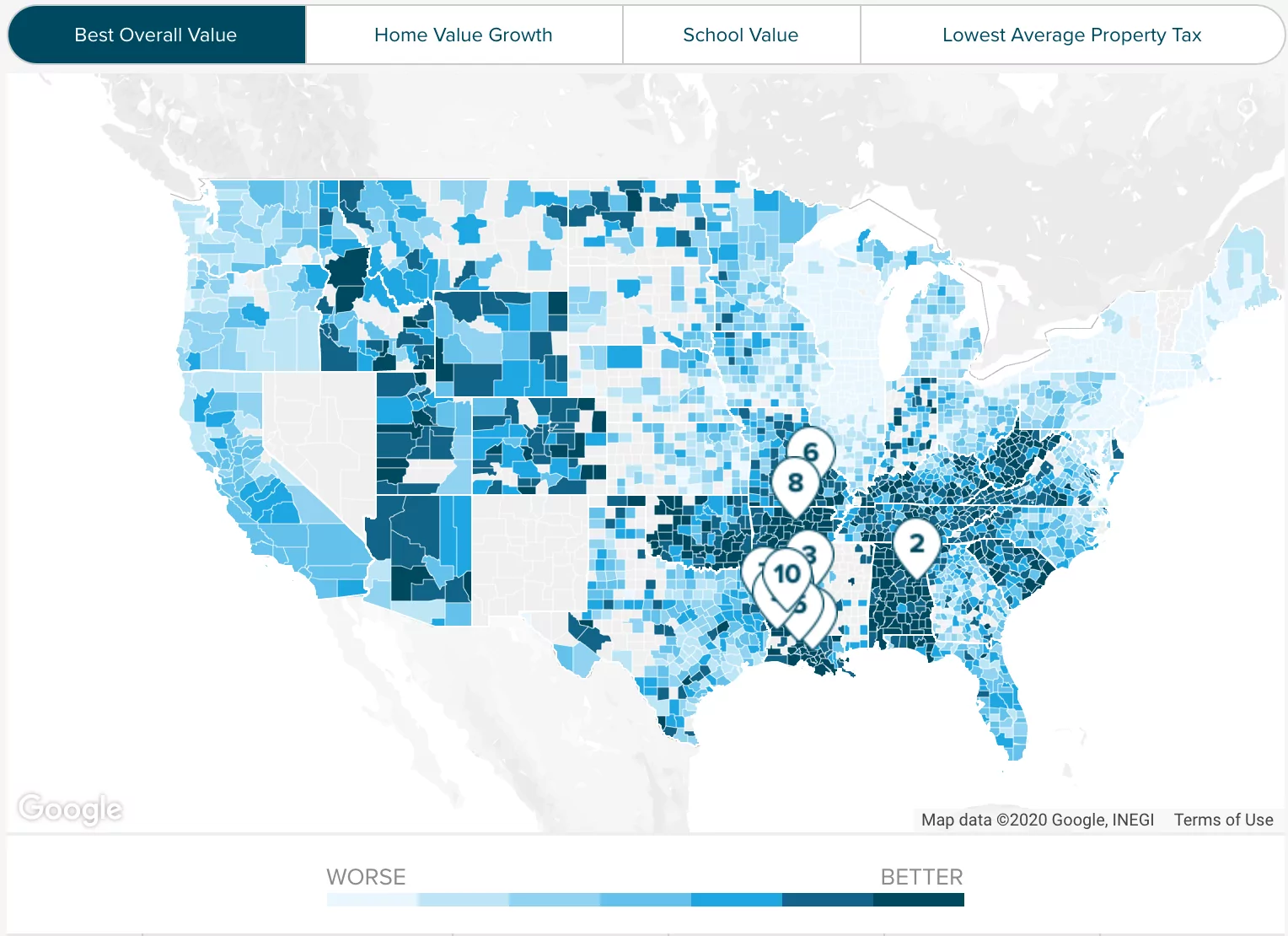

The median property tax in Santa Clara County California is. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median. Your base Prop 13 assessment will not change.

The average property tax rate in Santa Clara County is 067 of the market value of the home which is below the state average of 074 statewide. Supplemental assessments are designed to identify changes in assessed value either increases or decreases that occur during the fiscal year such as changes in ownership and new. Checks should be made out to County of Santa Clara.

Santa Clara County collects on average 067 of a propertys. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For the next step select an option to file your taxes to receive your e. The bills will be available online to be viewedpaid on the. But because the median home value in Santa Clara County is a whopping 664100 the median property tax amount in the county is 5275.

Learn all about Santa Clara County real estate tax. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Again California has enacted guidelines which county property assessors are obliged to honor.

File for free and get money back. Know what your tax refund will be with FreeTaxUSAs free tax return calculator. Yearly median tax in Santa Clara County.

The average effective property tax rate in Santa Clara County is 073. The average effective property tax rate in Santa Clara County is 079. Narrows the Assessed Value that can be transferred to two kinds of inherited property.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Sunday Oct 30 2022 1254 AM PST. Learn all about Santa Clara County real estate tax.

The median property tax also known as real estate tax in Santa Clara County is 469400 per year. The Santa Clara County California sales tax is 900 consisting of 600 California state. The bills will be available online to be viewedpaid on the same day.

Santa Clara County Property Tax Getjerry Com

How To Calculate Property Tax 10 Steps With Pictures Wikihow

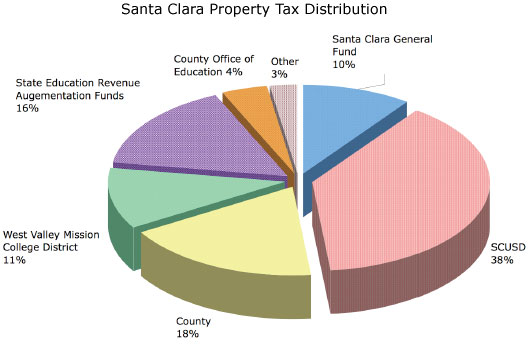

City S General Fund Gets Small Share Of Santa Clara Property Tax Dollars The Silicon Valley Voice

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Arizona Property Taxes By County 2022

Property Tax Calculator Tax Rates Org

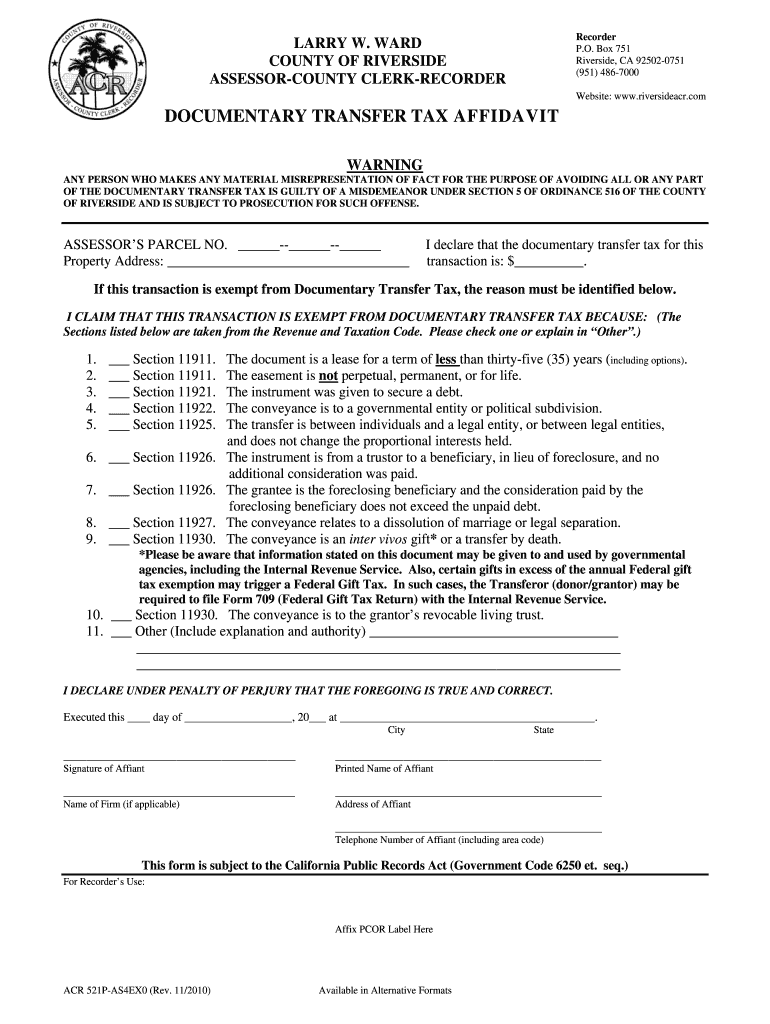

Santa Clara County Transfer Tax Affidavit Fill Out Sign Online Dochub

Los Angeles Property Tax Which Cities Pay The Least And The Most

Santa Clara County Ca Property Tax Calculator Smartasset

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Understanding California S Property Taxes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

How To Calculate Property Tax 10 Steps With Pictures Wikihow